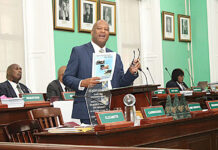

NASSAU, The Bahamas — Attorney General and Minister of Legal Affairs, Senator the Hon. Ryan Pinder reaffirmed The Bahamas’ strong commitment to international anti-money laundering and counter-terrorist financing standards as he delivered welcome remarks, January 22, 2026 at the Central Bank of The Bahamas’ 7th AML Research Conference,being held at the Margaritaville Resort.

Addressing delegates, researchers, regulators, and industry professionals, Senator Pinder welcomed international presenters and participants, noting that the conference has become a leading forum for empirical research and policy dialogue on financial crime, AML/CFT, and proliferation financing.

The Attorney General commended the Central Bank of The Bahamas and the conference’s organizing committee for sustaining a platform that brings together academics, practitioners, and policymakers to examine the effectiveness and real-world impact of global AML/CFT standards. He also acknowledged the support of the Bahamian banking and trust industry and the Central Bank’s leadership in advancing evidence-based discussions on financial crime.

Reflecting on earlier conferences, Senator Pinder highlighted long-standing concerns regarding the treatment of international financial centres by certain organizations claiming standard-setting authority outside of the recognized framework of the Financial Action Task Force (FATF). He emphasized that advocacy by small states matters, pointing to recent efforts by the FATF and the European Union to better align their AML listing processes, improving objectivity, transparency, and consistency in assessments.

The Attorney General noted that these developments are especially significant as the FATF’s 5th Round of Mutual Evaluations commenced in 2025, with Caribbean evaluations scheduled to begin in March 2026. The Bahamas is preparing for its own mutual evaluation in October 2026.

“Since 2002, The Bahamas has undergone four mutual evaluations and has invested heavily in legislative reform, institutional strengthening, technology, and human capital to comply with the FATF’s 40 Recommendations,” said Mr. Pinder. He highlighted major investments made through the Office of the Attorney General, including the expansion of compliance teams, digital platforms, training initiatives, and industry support, underscoring the cost and commitment borne by the Bahamian people.

While acknowledging concerns about the burden placed on small developing states, the Attorney General stressed that the cost of non-compliance is far greater, citing The Bahamas’ experience during its placement on the FATF Grey List from 2018 to 2020, which resulted in slowed investment and increased transaction scrutiny.

He further noted that eleven public-sector agencies are actively engaged in preparations to maintain The Bahamas’ “40 for 40” compliance rating, a milestone that previously positioned the country among a small group of global leaders in AML/CFT compliance. Ongoing efforts include updated national risk assessments and the extension of the National ML/TF/PF Strategy through 2028.

Senator Pinder emphasized the critical role of research and dialogue in strengthening AML/CFT frameworks and welcomed discussions on timely topics such as transnational corruption, asset recovery, real estate and politically exposed persons, and the relationship between suspicious transaction reporting and convictions.

In closing, the Attorney General welcomed regional colleague, the Honourable Lorna Smith, Minister of Financial Services, Economic Development and Digital Transformation of the British Virgin Islands, and wished participants a productive and engaging conference.