By Hadassah Hall

Nassau, Bahamas – Staff, faculty and students of The Bahamas Technical and Vocational Institute (BTVI) recently gained a wealth of knowledge intended to put them on the road to financial success.

The seminar was a financial wellness check-up with representation from leading banks, insurance and credit union companies.

BTVI’s coordinator of Student Affairs, Racquel Bethel underscored the importance of fiscal prudence. “It is paramount; hence such a seminar would prove to be of great value in these already economically-challenging times. It is our hope to expose our BTVI family to the benefits of financial planning and get them on the right path for the new year,” she said.

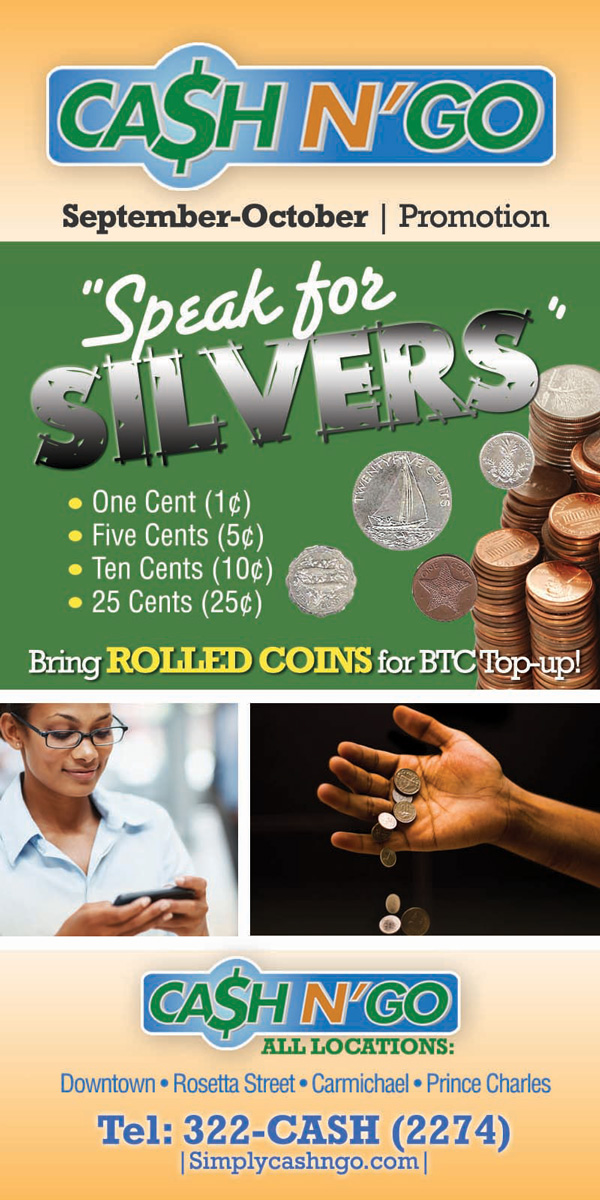

Lively and informative presentations were made on budgeting, savings, insurance and retirement planning by representatives of Commonwealth Bank, Royal Bank, the Teachers and Salaried Workers Cooperative Credit Union, FamGuard Group of Companies and Cash N’ Go, a subsidiary of the Bahamas Assurance Financial (BAF) Global Group Ltd.

One BTVI employee, who spoke on the condition of anonymity, said the seminar changed her mindset.

“Every month I buy a new shade of lipstick,” she confessed. “Instead of spending $50 on MAC makeup, I’ll save it,” she resolved.

“They taught me life lessons about budgeting. They were realistic. They said how Bahamians work from paycheck to paycheck. I’m going to hike up my savings because you never know what may happen,” said the 24-year-old.

Meanwhile, Tanya Pinder-Carey, a Credit Officer at Commonwealth Bank , noted that the average Bahamian only has about one month’s salary available to live on in the event of termination. She underscored the importance of saving, while Wesley Percentie, Senior Wealth Manager at FamGuard Group of Companies encouraged attendees to not live above their means and save towards retirement.

“You must be prudent in savings and investment practices. National insurance is not sufficient following retirement. Save from now. Now is the time to begin saving,” stressed Mr. Percentie.

Additionally, Jevon Butler, Business Development Manager of Cash N’ Go noted that in order to invest it requires sacrifice. “A man is a slave to his lender. Don’t allow emotions to affect your money,” he advised.

Mr. Butler further advised that long-term investments should not be based on today’s salary as there may be interruptions to employment including retirement or termination. “Spend on long-term expenditures, what you can still pay in 20 years,” he recommended.

Several attendees described the panelists as “real” in their advice and afterwards took the time to meet one-on-one with representatives to receive additional information in their quest for fiscal fitness.