Carl Bethel comes out to attack members of the Press who supports Hubert Ingraham…

The Editor,19th November, 2013

Nassau, Bahamas

Dear Sir,

Having read the article by Ms. Candia Dames entitled: “VAT: How we got here – A Note to Minnis” I was astounded at what appears to be a journalistic ‘hatchet job’.

Ms. Dames has taken it upon herself, no doubt in her genuine perception of the National Interest, to engage in a lengthy public debate which, unfortunately, verges upon a personal attack upon the FNM Leader, especially when the writer digresses into the realm of discussion about the gambling referendum.

What is somewhat puzzling is that after all the apparent invective in the piece, the writer then round off the article by agreeing with virtually everything which Dr. Minnis demanded in the short statement which he issued, after consultations with his colleagues.

The writer reminded us that the Guardian had published some leaked information (purportedly of draft legislation) and then says; “The debate cannot be vibrant and well informed without the official release of what is being proposed”. This is exactly what Dr. Minnis had demanded.

Let me remind the writer that Prime Minister Perry Christie, himself, during his Mid-term Budget Communication specifically stated: “Our target is to circulate the draft legislation for VAT by the second quarter of the next fiscal year”. We are already more than half way through that “second quarter of the…fiscal year” and the government has still not officially tabled or released any draft legislation. Again, all that Dr. Minnis has asked is that the government live up to its commitments and conduct its affairs with the transparency that such a critical debate demands.

The writer then states that: “Many people are indeed awaiting the release of an economic impact study to show specific projections resulting from the VAT implementation, including the projected cost of living impact.” This information would certainly be covered in the FNM Leader’s broad request for full disclosure by the government of all relevant information.

The writer should be reminded of the Prime Minister’s own words in his Mid-term Budget Communication in February, 2013, where he stated: “We have had the benefit of detailed studies of the feasibility of a VAT in The Bahamas”. Where are those “studies” and why have they not been disclosed to the public?

This is what Dr. Minnis demanded: “The PLP should immediately disclose to the Bahamian People the details of any economic studies and analyses either by domestic or international advisors or agencies which have led the government to this proposed course of action. The government must also disclose to Bahamians whether they have explored ALL potential alternatives available in order to expand the tax revenue base, and disclose any such reports which have detailed alternative tax solutions, other than a VAT system; stating why the government decided to propose VAT instead of the many alternative systems which could have been proposed.”

Dr. Minnis accused the government of making a “sudden lurch” to a VAT. The writer also concludes that: “It might be in the interests of everyone (for the government) to push off the implementation by a few months. It would allow the business community and consumers to better digest the details of VAT”. It seems that the writer, in fact, agrees with Dr. Minnis that the government’s VAT imposition agenda is indeed, in the circumstances, too rushed and too hurried.

Dr. Minnis also called for the government to accompany any proposed tax increases with a clearly articulated policy, plan or programme to limit the growth of public spending, to eliminate waste and abuse of public finances. The writer, while repeating Bradley Roberts’ claim that the FNM borrowed an extra $2 Billion Dollars in five years, merely notes the fact that the PLP government has already borrowed $1.115 Billion in just over one year.

In his Mid-term Budget Communication in February, 2013 the Prime Minister was only able to document the following “carry-over expenditures” left by the Ingraham FNM government:

Un-paid cheques, etc. – $63.14 Million

52 Week Job Programme- $23.0 Million

Teachers/Public Service lump sum payments- $10.8 Million

Add in the $50 Million projected over-expenditure on the Road Improvement programme, and assume that the Ingraham government left $150 million in un-paid bills; how does a $150 million shortfall in one year provoke $1.15 Billion dollars in government borrowing a little more than a year later? Something just doesn’t add up here. The government must explain this anomaly.

What should be of concern to every Bahamian is that the rate of growth of the deficit, under the present government, has apparently speeded up significantly. In just over one year the PLP has managed to rack up more than one half as much as the FNM borrowed over a five year period.

This rapid escalation of the rate of borrowing under the PLP must be truly alarming to the financial markets, but such a hefty escalation in borrowing since May 2012, cannot be laid at the feet of the Ingraham Administration. Such a rapid escalation of borrowing was clearly the choice of the Christie Administration.

In these circumstances it was entirely reasonable for Dr. Minnis to demand that any proposal to increase the tax burden on the Bahamian people should also, if it is to be taken seriously, also include real and meaningful policies, laws and procedures which are designed to limit the growth of non-essential, discretionary, spending by the government.

There are two further factual issues which ought not to be fudged. The writer quotes extensively from a recent speech given by former Minister of State for Finance Zhivargo Laing. At no point did Mr. Laing ever state that the FNM government had “decided” to implement a VAT. He said that “we looked at it….and would have given it early consideration”.

Need I remind the writer that to “look at” or even to “give early consideration” to something is not the same thing as actually deciding to do something. The FNM government never decided as government policy that it would implement the VAT. Period. It might well have done so, after appropriate consultation (which is all that Dr. Minnis has, so far, demanded) but the electorate decided otherwise.

The second misconception to be addressed is this: Dr. Minnis has merely, so far, demanded appropriate consultation, appropriate plans and programmes to reduce spending, and appropriate information. His statement that the VAT is a regressive tax is a statement of fact. Any economist would confirm that fact. It was not a value judgment. The Leader of the FNM has not, to this point, expressed any position, much less any final position, on the question of what methodology would best assist the government in expanding the tax revenue base, if such expansion of the tax base were truly a necessity.

Dr. Minnis has demanded that the government ensure that any revenue enhancement measures do not become a prop for further wanton borrowing to finance wasteful spending. He was right to do so since no revenue enhancement measure can, by itself, solve what Ms. Dames herself calls a fiscal “crisis”. Without meaning curbs and reductions in public spending, the introduction of VAT or any other system will merely facilitate even more “borrowing to spend”. No one can ‘borrow and spend’ their way out of debt.

A case in point: The Central Bank predicts that the debt to GDP ratio of The Bahamas this year will be 61%. That is high, but not as high as the debt to GDP ratio of Barbados, which implemented VAT several years ago, and whose debt to GDP ratio at the end of 2012 stood at 83%. Even with VAT, Barbados has still borrowed more money as a percentage of the size of its economy than has The Bahamas, which does not have VAT!

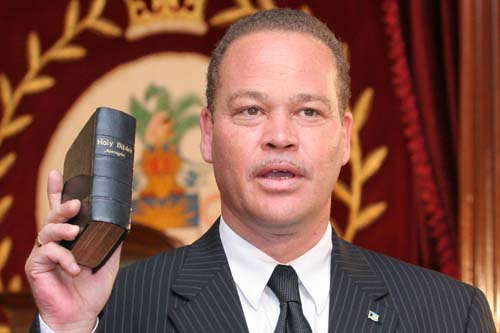

Carl W. Bethel