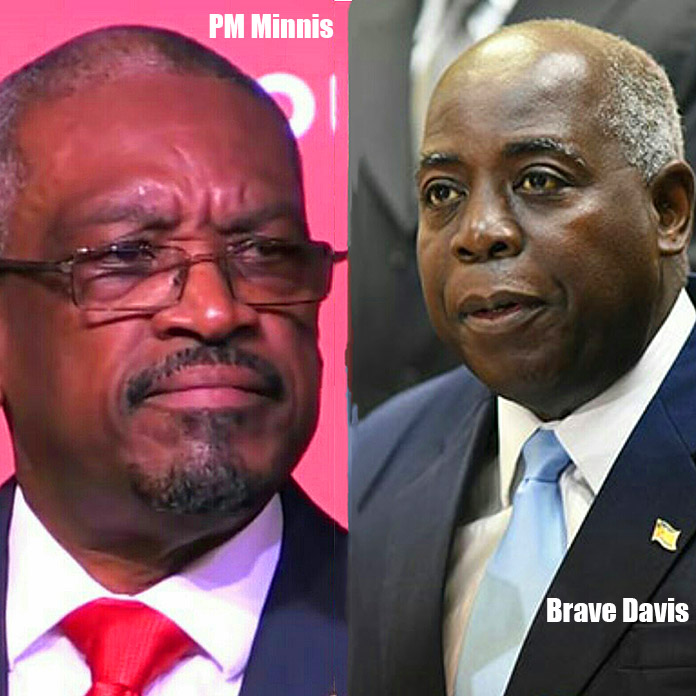

STATEMENT FROM THE OFFICE OF THE LEADER OF THE OPPOSITION

2018/2019 Budget Communication: Evidence of Failure

31ST MAY 2018

The Ministry of Finance has failed. The 2018/2019 Budget Communication provides ample evidence of its failure. The key agencies of the Ministry of Finance, Customs and the Department of Inland Revenue are not performing, notwithstanding strong economic growth and the tens of millions invested in these agencies by the previous administration. The reason is simple, the Government has stopped, reviewed and cancelled the very sensible policies put in place by the previous administration. Now the Government is desperately seeking to restart these programmes.

“We will also re-energize the reform and modernization exercises that have been launched in respect of the major tax areas, such as Customs and Real Property Tax.”

They must re-energize the reform and modernization because of reckless and short-sighted actions. Unfortunately, this re-energizing and modernization would take time before any tangible results are seen so the tax spiral which has now commence in 2018/2019 Budget Communication will continue as the Government attempts to achieve the overly ambitious targets of the draft Fiscal Responsibility Act, unless there is a fundamental re-ordering of fiscal policy in The Bahamas.

The signs of failure are littered throughout the Communication. For example, in the Customs Department notwithstanding the currently implemented IDB funded Trade Sector Reform, the Minister of Finance is insisting on another review of customs procedures.

“A full management audit of Customs procedures and processes will be undertaken to determine the extent to which they deviate from international best practice and the best way forward to close the gaps that are identified.”

Why is this necessary? Does this not reflect concerns with the current leadership of Customs? A leadership which has been installed by the current administration. Why is the Ministry of Finance not seeking to push for the full implementation of the Electronic Single Window, which would have automated many of the customs procedures reducing the ability for malfeasance by officers and increasing revenue without adjusting tax rates? $12 million have been borrowed from the IDB for this application but its full implementation has been delayed several times under this administration.

The Minister also spoke about the floundering Revenue Enhancement Programme. When the previous administration left office the Revenue Enhancement Programme was hardly floundering as it was generating $25 million a month. This programme was also stopped, reviewed and cancelled, with most of the staff, who were trained at great expense of the Government, being terminated and more concerning Customs Department, under the leadership installed by the current administration stopped cooperating. Why? Was it because the programme was too successful and impacting politically sensitive companies?

Demonstrating the absolute failure of the Ministry of Finance is the Government’s intention to amend the Financial Administration and Audit to foster cooperation between the agencies of the Ministry of Finance. What is stopping the Minister of Finance from instructing his agencies which all report to the same senior public official (Financial Secretary) to cooperate?

“To that end, the Revenue Enhancement Unit, another example of an initiative simply floundering under the previous administration, is being recast to ensure that revenue is properly and fully collected across the major tax segments. To facilitate these efforts, an amendment is being proposed to the Financial Administration and Audit Act to provide the authority to the Ministry of Finance to form an inter-departmental unit that will be assigned the task of revenue enhancement across the major areas of taxation.”

The cost of this failure is a 60% increase in VAT, Police certificates now at $20, higher fees for Immigration, Road Traffic and punitive taxes on gaming houses jeopardizing over 3, 000 Bahamian jobs. Meanwhile, the Minister and his Ministry face no sanction or public rebuke. This is wrong, and the Prime Minister must act.