By E. Williams

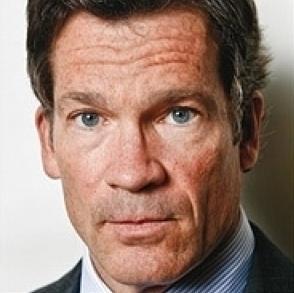

(1st July 2012-Nassau Bahamas) — Did financial authorities in The Bahamas know that when they licensed a certain offshore bank it could be used as a money-laundering facility, a camouflage to avoid certain international taxes and fall under the control of Louis Bacon, the controversial and reclusive Hedge Fund kingpin who has had several hefty international fines slapped on his operations in recent times?

Reports are that international financial watchdogs are now on to the operation. And notwithstanding the numerous Tax Information Exchange Agreements signed between The Bahamas and other countries and public policy to keep this island nation’s financial services out of the dire straits of being blacklisted, something may have slipped under the radar.

These and other unsavory facts are beginning to spill out as Mr. Bacon has now reportedly threatened to shut down the bank and send forty-one (41) Bahamians home. However inside political sources are saying that the move to close the bank by Mr. Bacon has two intended purposes:

(1) To brow beat and compromise the new PLP Administration into “a friendlier posture” with Mr. Bacon.

(2) To shake up the new Government on the possible loss of jobs in the financial sector.

Mr. Bacon’s company was fined $25 million dollars by the US Government in 2010 for fixing Commodity markets and has long been under the radar of international regulatory agencies. His controversial 250,000 British sterling cash (equivalent to US$500,000.00) gift to the British Conservative Party just before David Cameron won the British Elections, was returned to him after it was revealed that Mr. Bacon was drawing regulatory investigation in that country.

Mr. Bacon, an American, is a big financier of the Mitt Romney Republican run for the White House this fall.

However Mr. Bacon’s last political funding venture in the FNM’s re-election bid ‘crashed and burned’ on May 7th, as the former Government was routed out of office by the Bahamian electorate.

The controversial offshore bank may have been licensed as far as back as 2000 but in August 2009 it became increasingly active. Various FNM Officials, from top Senate and House of Assembly members to high ranking corporate and public officers, have benefited from “gifts and rewards” for allowing the Bank to do business, this reporter has learnt.

Now Mr. Bacon is reportedly telling the Bank’s clients and the Board of Directors that he will shut it down because the new PLP Government of The Bahamas is unfriendly towards him and does not want him back in the country.

About forty-one employees of the Bank have been told they can be out of job as soon as August of this year.

“What Mr. Bacon is doing is very clever. Recognizing that he no longer has the protection of the big wigs in the FNM Government to cover his tail and trail, he has gone about selling to his board and shareholders that he is shutting down because of pressure from the new Government in The Bahamas,” says a former close associate of former FNM Minister Earl Deveaux, long reputed to be “Mr. Fix It” for Mr. Bacon when Mr. Deveaux held the Environment portfolio.

It is said in financial circles that the real reason for the shut-down is a reported probe of US regulators into Mr. Bacon’s operations in The Bahamas which is reportedly proposing to move the funds of the hedge fund to Canada while, for tax purposes, maintaining some kind of management operation in The Bahamas to give an impression that it is a Bahamas-based hedge fund.

“I am sure that Bacon is aware of the fact that his license to operate in this manner from The Bahamas is in peril when considering the fact that in the face of international blacklisting, the PLP Administration in 2002 decided not to entertain an application for the renewal of the license of the now infamous offshore bank, Suisse Security Bank & Trust, owned by the family of Sheik Mohammed Harachji and been shut down because of Intelligence Reports handed to them upon assuming office”, the source said.

“Strangely enough the same people who may now be pushing the Bacon agenda were instrumental in ensuring that the Harachji family was not reinstated with a license for their controversial bank which was shut down by the Central Bank in what became a nasty and crude entanglement with the former Governor of the Bank being labeled by the Sheik even as the Bank took its actions in pursuance of its authority”, the source says.

Here are the troubling reported facts and coincidences:

(1) Mr. Bacon funded the FNM re- election campaign.

(2) In 2002, it was discovered after the Harachiji family had lost their bank license under the FNM administration, money was being funneled from the Harachji bank to FNM operatives before the US authorities came calling on the bank’s controversial operations.

(3) Some of the same banking officials who worked for the Harachji Bank are reportedly also engaged by the Bacon Offshore Bank.

(4) A leading Bahamian law firm headed by a former member of the pre-Independence Minority Government and a resident of Lyford Cay, where Mr. Bacon resides at his multi million dollar Point House compound, may have structured the bank’s application to the Central Bank.

Meanwhile, associates of Mr. Bacon have reportedly been blocked in the Cayman Islands and the Turks and Caicos Islands from offshore banking licenses because British Intelligence was able to diligently discover “suspicious details” behind these applications, a source in the financial sector in Cayman says.

Mr. Bacon’s operations have been the subject of intense scrutiny of reputable international financial publications like the Wall Street Journal and the Financial Times of London.

In 2010 citing Mr. Bacon “for…this kind of unsavory approach that has led to significant regulatory scrutiny”, the WSJ said that Mr. Bacon and his company had been subject to a fine of $25m to settle accusations that one of his managers tried to unlawfully manipulate futures prices. (http://online.wsj.com/article/NA_WSJ_PUB:SB10001424052748704256604575295053318855446.html). In the UK last year, the London Office of the Hedge Fund that Bacon runs, was raided by the Financial Services Authority and the Serious Organized Crime Agency “…normally used to fight drugs, crime and international terrorism…” that led the arrest of several of his employees. (http://www.efinancialnews.com/story/2010-05-24/managers-fear-the-long-arm-of-the-law). The London operations was cited with a heavy fine.

“Who in their right mind in the Central Bank would have even approved this offshore banking license where Bacon is the master manipulator? That is why concern is being raised over how this Shirley Street law chamber got duped into the banking fiasco” the source asks.

“When you are trying to run a squeaky clean operation you got to have integrity at the highest levels. You can’t have strikes against you in the UK and the USA and when you get to The Bahamas you get a free pass. It says we are a nation for sale and someone has to take responsibility for that and be punished. Let the facts be disclosed and let the public know everything about Mr. Bacon and his offshore Bank before the last document is shredded, all the hard drives are swept clean with lawyers getting injunctions to keep the records shut and closed to public inspection and scrutiny while bodies start washing up on the shores of Lyford Cay and just as suddenly disappearing with no explanation.” a former Central Banker said.